Compliance audits are an essential part of any organization’s financial operations. In order to ensure that the company is operating in accordance with applicable laws and regulations, it is important for organizations to prepare thoroughly before undergoing a compliance audit. This article provides guidance on how to adequately plan and prepare for such an audit.

The first step in preparing for a compliance audit is understanding the scope of the audit. It is critical to be aware of what topics are going to be covered by the auditor so that appropriate preparations can be made. The second step involves gathering all relevant documents necessary to facilitate the auditing process. These documents should include financial statements, contracts, internal policies, and procedures, as well as other relevant records required by law or regulation.

Finally, it is important for companies to have staff members available who are knowledgeable about their industry’s rules and regulations and able to answer questions from the auditor effectively. To successfully complete a compliance audit, organizations must understand what needs to be done prior to the start of the audit in order to minimize complications during the actual examination process.

Definition

Compliance audits are an important tool for organizations to gauge their adherence to set standards and regulations. It is a systematic process of evaluating the implementation and effectiveness of an organization’s internal control system in order to ensure that it meets its objectives. An audit assesses the accuracy, completeness, and reliability of financial records as well as compliance with applicable laws and regulations. Auditors use various techniques such as interviews, questionnaires, observations, comparisons, sampling, and document reviews to determine whether proper controls have been established within the organization’s operations.

Audit definitions can vary depending on the purpose of the audit or what type of standards the auditor is trying to evaluate. For instance, a compliance audit may be defined as an independent evaluation conducted by certified auditors who must adhere to specific protocols developed by regulatory bodies; while a financial statement audit might focus more on ensuring that reported numbers accurately reflect economic reality. Similarly, operational audits investigate how efficiently procedures are being implemented across departments within an organization while forensic audits examine suspicious activities related to fraud or corruption.

Irrespective of its definition or scope, however, all types of audits generally follow similar processes such as planning & risk assessment; documentation review & analysis; test execution; final reporting & corrective action plan creation. These steps form the backbone for any successful audit since they allow both parties – auditors, and stakeholders – to gain valid insights about existing systems and uncover areas needing improvement before any legal implications arise from non-compliance issues.

Types Of Audits

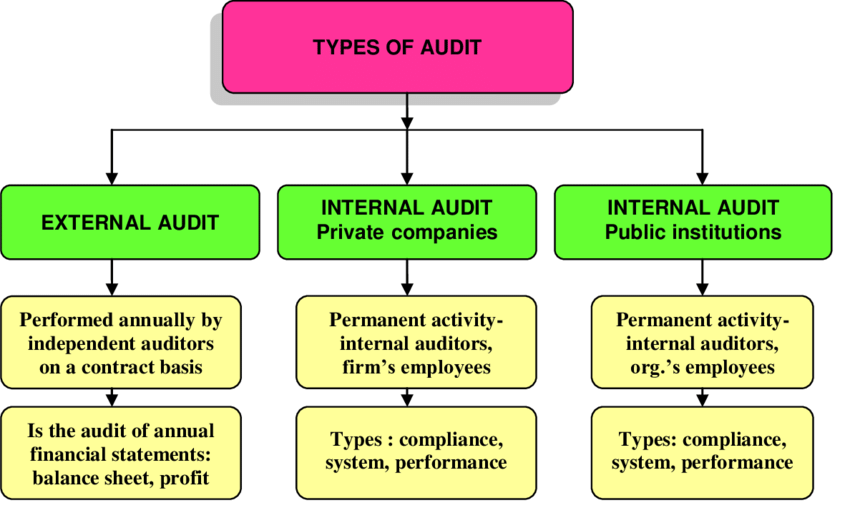

When it comes to audits, there are various types of auditing techniques that organizations can employ. The most prominent among these include compliance audits, non-compliance audits, and regulatory audits. Understanding the different audit types is essential for any organization in order to adequately prepare for an audit.

Compliance audits typically focus on reviewing internal control systems and processes used by firms to ensure they meet all applicable laws or regulations. This type of audit involves examining documents, records, policies, and procedures in order to identify instances where a company may be noncompliant with rules set forth by governing bodies. An auditor will analyze management’s system of internal controls as well as financial reporting standards in order to determine whether proper activities have taken place within the firm’s operations.

Non-compliance audits also assess internal controls but instead look at areas that do not conform to established standards or requirements; such as those from industry associations or professional bodies. They help uncover fraud, waste, abuse, and mismanagement that could potentially lead to legal implications if left unchecked. Regulatory audits meanwhile are conducted when companies must demonstrate their adherence to specific legislation or government agency guidelines – usually related to health & safety matters or environmental issues.

By understanding the different types of auditing techniques available, organizations can better evaluate what approach best suits them depending on their particular circumstances and goals. This allows both parties -auditors and stakeholders-to gain valid insights about existing systems while simultaneously helping them prepare for a successful audit process free from any potential non-compliance issues.

Assessing Your Current Compliance

Assessing your current compliance is a critical component of preparing for any audit. Without proper assessment, organizations risk facing substantial consequences due to non-compliance issues that could have been avoided with the right level of preparation. Compliance assessments are designed to help firms identify and address existing weaknesses in their internal control systems prior to an audit taking place – thus enabling them to reduce potential risks associated with failing to meet regulatory or other standards set forth by governing bodies.

When it comes to assessing its own compliance preparedness, one must take into account both external and internal factors which can affect the outcome of an audit. External factors involve laws and regulations applicable to the organization’s sector while internal ones include management’s system of checks and balances as well as financial reporting standards. It is essential for businesses to review all aspects of their operations thoroughly in order to ensure they are meeting necessary requirements without overlooking any potential deficiencies. This process should also investigate areas where additional controls may be needed in order to maintain full compliance – such as those related to anti-money laundering efforts or data security protocols among others.

Conducting a comprehensive review of one’s organizational structure helps companies gain better insight into their overall compliance posture; allowing them ample time before the actual audit date arrives so that appropriate corrective actions can be taken if required. Once this step is completed, then organizations will be armed with sufficient knowledge about their existing state of readiness when it comes time for the formal auditing process itself – ultimately leading to greater success during the exercise.

With these considerations in mind, it becomes clear why assessing current compliance is absolutely fundamental for any business aiming at achieving total confidence in its ability to pass an upcoming audit.

Checklist For Preparing For The Audit

The audit preparation process should begin with the development of a comprehensive checklist. This will help ensure that all necessary steps have been taken to adequately prepare for the upcoming compliance audit. The list should include items such as gathering and organizing relevant documents; reviewing internal control policies and procedures; validating financial statements; assessing operational risks, IT security measures, segregation of duties and data privacy protection protocols; conducting an internal review or mock-audit if possible; and making any needed changes to processes prior to the actual external audit date.

For organizations not familiar with how best to go about preparing for a compliance audit, there are plenty of resources available online which can provide helpful tips on this matter. These guidelines typically cover topics ranging from knowing what information must be provided in order for auditors to conduct their work effectively, to setting up lines of communication between management teams and external auditors so expectations are clear before the exercise begins. Ultimately, it is important for businesses to create an environment where they feel comfortable communicating openly throughout the entire procedure – thus facilitating both sides’ ability to arrive at accurate results in a timely manner.

Finally, after developing an effective preparation plan informed by various sources, firms need to take actionable steps toward collecting, analyzing and documenting data required for the assessment itself. With these critical elements properly accounted for during the pre-audit phase, organizations will be in a much better position when it comes time for their face-off against external examiners.

Collecting, Analyzing, And Documenting Data

Collecting, analyzing, and documenting data are essential steps in preparing for a compliance audit. To ensure that the process goes as smoothly as possible, organizations must have a clear understanding of what information is required to be provided during the assessment phase. Data collection should begin with gathering all relevant information both internally and externally, such as policies, procedures, and financial statements. Once collected, this data needs to be analyzed thoroughly using professional accounting tools to identify any potential risks or areas of concern prior to the audit itself.

The analysis should include an evaluation of internal controls used by the organization; segregation of duties among staff members; IT security measures taken; and protection protocols implemented for safeguarding sensitive customer data. Accurate documentation of these processes allows auditors to review them more quickly and efficiently when assessing company operations during the external examination phase. Furthermore, having well-documented procedures can also help minimize disruption caused by unexpected delays in receiving requested materials from management teams – thus improving overall operational efficiency throughout the entire process.

Organizations looking to optimize their chances for success may want to consider investing in proper training on how best to prepare for an upcoming compliance audit. With knowledge acquired through dedicated instruction programs, businesses can develop appropriate strategies tailored specifically toward meeting their unique requirements while mitigating risk exposure at every step along the way. This comprehensive approach will ultimately provide firms with greater confidence that they have done everything within their power leading up to the actual event itself.

Understanding The Process Of An Audit

A successful compliance audit requires an understanding of the entire process, including its various stages and timelines. To achieve this goal, organizations should first familiarize themselves with their respective regulatory body’s requirements for conducting such assessments. This is important as each authority may have different procedures that must be followed in order to ensure a thorough examination of all relevant operations within companies.

Once these guidelines are clear, it is essential to begin preparing internal documentation which can be provided during the assessment phase itself; this includes business processes, company policies, and financial records. Additionally, firms should establish specific protocols for handling any inquiries received from auditors during the course of the review in an efficient manner – so as not to delay completion times or cause unnecessary disruptions.

Finally, while it is important to understand the technical aspects of an audit, it is equally critical that staff members remain adequately trained on best practices pertaining to responding appropriately to requests made by external bodies throughout the duration of the procedure. TIP: Make sure you keep your team up-to-date on changes in regulations and industry standards so they know what’s expected when interacting with auditing personnel. By taking proactive steps towards mastering both theoretical and practical frameworks involved in audits, businesses can increase their chances for success before even beginning their own assessment process.

Training Staff

In order to ensure staff members have the requisite knowledge and understanding of compliance audit procedures, organizations should consider implementing a comprehensive training program. This will provide employees with an opportunity to gain insights into both technical issues related to regulatory requirements as well as practical matters such as responding effectively to inquiries from auditors.

Training should also include detailed information about how best to transfer knowledge between departments in order to maximize audit preparedness. It is important that teams understand not only their own roles but also those of other units within the organization; this can help foster greater collaboration when it comes time for an assessment.

Additionally, organizations may want to explore methods for incorporating audit education into their onboarding process for new hires or via refresher courses for existing personnel on a regular basis. Doing so can help ensure all staff has access to relevant resources without having to invest substantial amounts of time each year in training activities. By providing these opportunities and investing in employee compliance efforts, companies can increase the chances of successful audits while limiting potential risks associated with non-compliance. With adequate preparation and proper instruction, organizations are better positioned to meet any challenges posed by external bodies during assessments.

Communicating With Stakeholders

Clear communication with stakeholders is a critical component of audit preparedness. Organizations should consider how best to inform key individuals about upcoming compliance audits, as well as any necessary changes or procedures that will be implemented in order to ensure the assessment goes smoothly. Companies may want to make use of both internal and external channels for relaying information; this could include anything from sending out memos to employees or utilizing social media outlets to reach larger audiences.

Additionally, it can be beneficial for organizations to have a plan in place for responding quickly and accurately to questions posed by stakeholders throughout the process. This helps provide assurance that everyone involved understands what is expected of them during an audit and can help reduce potential misunderstandings between parties. It is also advisable for companies to review their existing policies regarding external communications so they are aware of any potential risks associated with sharing sensitive data with auditors or other third parties before beginning an assessment.

To ensure clear communication leading up to a compliance audit, organizations should take steps such as:

• Establishing protocols for informing stakeholders of impending assessments

• Designating points of contact within departments that are responsible for fielding stakeholder inquiries

• Creating documentation related to policy changes prior to an audit

• Reviewing existing regulations related to public disclosures These efforts can help organizations maintain open lines of dialogue while demonstrating their commitment to meeting regulatory obligations.

Getting Professional Assistance

Organizations may find that seeking professional assistance can be invaluable when preparing for a compliance audit. Professional audit assistance providers offer specialized expertise and knowledge of the relevant regulations, as well as experience in dealing with audits from start to finish. This type of guidance can help organizations ensure they are meeting their obligations while also helping them to identify any potential issues before they escalate into serious problems.

When choosing an audit consultancy or specialist, companies should look for firms or individuals who have extensive experience in providing compliance auditing services. Additionally, it is important to consider whether the provider has been involved in similar assessments prior to selecting one; this helps to guarantee that the consultant understands the specific requirements associated with the particular assessment being conducted. Companies might also want to check if these professionals have appropriate certifications related to compliance-related topics, such as risk management or data privacy laws.

Finally, having access to external resources during an audit can make all the difference between a successful assessment and one that results in costly penalties or sanctions. Audit preparation help provided by experienced consultants and specialists can help organizations achieve regulatory standards without sacrificing efficiency or productivity. By engaging the services of experienced audit compliance specialists and consulting services at key points throughout the process, businesses can be better prepared for upcoming assessments and reduce overall risks associated with noncompliance.

After The Audit

The audit process is like a journey, with the end goal being to arrive at an accurate assessment of compliance. Once this destination has been reached and the audit is concluded, there are several key steps that should be taken in order to ensure the most effective review and utilization of the results. These include reviewing the audit report and findings, assessing any corrective actions that may be necessary, monitoring changes made as a result of the audit, and communicating the conclusions of the assessment to stakeholders.

The initial step after an audit conclusion is to review all relevant documents thoroughly so that there is an understanding of both what was found during the assessment and how those findings have been addressed within the organization. It is important for organizations to consider potential impacts on their operations due to changes or corrections identified during the audit process. Additionally, companies must also take into account feedback from stakeholders who were part of or affected by the auditing procedures when determining the next steps.

Organizations must then work to implement any corrective measures required in accordance with applicable regulations as soon as possible; this includes ensuring that policies, processes, and controls remain compliant going forward. Finally, it is essential for businesses to communicate effectively about their progress toward achieving regulatory standards. This entails clearly articulating any improvements made following an audit review and providing updates whenever necessary during future assessments. By taking these specific steps after each compliance audit, organizations can help ensure they maintain appropriate levels of adherence while continuing regular operations efficiently.

Frequently Asked Questions

- How Should I Allocate Resources For The Compliance Audit?

Allocating resources for a compliance audit is an essential part of resource planning. Properly allocating resources will help to ensure that the audit preparation and strategy are successful. The first step in determining how to allocate resources is assessing what areas within the organization need attention during the audit. This assessment should be done by reviewing existing policies, procedures, and any relevant documents related to the audit. Once this has been completed, it can provide insight into where there may be weaknesses or gaps in terms of compliance requirements.

The next step is then to determine which personnel have the appropriate skillset and knowledge necessary to address these issues during the audit. Personnel must possess both technical expertise as well as an understanding of regulatory requirements surrounding areas such as data security and financial reporting. It is important to remember when making staffing decisions that cost-effectiveness must also be taken into consideration.

Finally, once roles have been assigned and personnel staffed appropriately, the focus shifts towards setting up systems or processes that allow those involved with the compliance audit to collaborate efficiently while providing adequate oversight throughout its duration. By ensuring the proper allocation of resources prior to beginning the compliance audit process, organizations can benefit from increased efficiency and more accurate results overall.

- How Long Does A Typical Compliance Audit Take?

The length of a typical compliance audit depends on several factors. The timeframe of the audit may vary depending on the size and complexity of the organization being audited, as well as the scope of work that needs to be done in order to properly assess their compliance with relevant regulations. Additionally, organizational policies and procedures can affect how long an audit might take, such as whether or not certain records are available for review during the process. In general, most audits do not exceed two weeks in duration; however, it is important to keep in mind that some organizations may require additional time due to their specific circumstances.

When preparing for a compliance audit, it is essential to have an accurate understanding of its estimated duration. This will help determine which resources need to be allocated toward completing the project within the allotted timeframe. The auditor should discuss this information with their client prior to beginning any work so both parties can agree on expectations regarding the timeline and budget constraints associated with the audit. Knowing how much time is needed for completion beforehand helps ensure all stakeholders involved have realistic expectations about when results can be expected from the assessment.

It is also important for companies who are undergoing a compliance audit to remember that no matter what regulatory requirements they must adhere to, taking too long on an audit could potentially lead to missed deadlines and unmet goals. Therefore, having a clear idea of how long each phase will last before starting is key to avoiding delays and helping stay organized throughout the entire process.

- What Risks Should I Be Aware Of During A Compliance Audit?

The implications of a compliance audit can be daunting and overwhelming, particularly for businesses that have not adequately prepared in advance. A critical element to ensuring success during an audit is understanding the risks associated with it. As such, identifying potential risks prior to the commencement of an audit is paramount. By doing so, businesses can develop appropriate risk management strategies and implement effective audit preparation techniques to mitigate any issues or complications that may arise throughout the process.

When evaluating the potential risks associated with a compliance audit, common areas of concern include audit compliance issues; insufficient evidence or documents; inadequate recordkeeping; improper staff training; system errors or omissions; data security flaws; and incorrect financial reporting methods. All these areas should be addressed prior to commencing an audit as they may lead to costly delays and/or penalties if unresolved. It is important to note that any additional costs incurred due to mismanagement will ultimately fall on the business being audited.

To minimize this exposure, businesses must ensure all relevant personnel is trained and informed about the specific requirements of their particular industry sector before beginning an audit. This includes having accurate records for each transaction and preparing detailed reports outlining any changes made since the last period under review. Additionally, companies need to remain up-to-date with current laws regarding data protection regulations so as not to inadvertently expose themselves to unnecessary liability down the track.

Risk mitigation is essential when undergoing a compliance audit – taking proactive steps now can save money and time later on by avoiding fines or other legal sanctions resulting from non-compliance or negligence on behalf of those involved in performing the assessment activities. Adopting sound practices including clear communication between parties, well-defined procedures, document control systems, and quality assurance processes will go a long way toward helping organizations pass audits quickly and easily while protecting their interests at all times.

- What Is The Most Common Type Of Non-Compliance Issue Found During A Compliance Audit?

The most common type of non-compliance issue found during a compliance audit is the failure to adhere to regulatory requirements. This can take many forms, such as failing to accurately document transactions or having inadequate internal controls in place. During an audit process, auditors will review documentation and analyze data to identify any discrepancies between what has been reported and what should have been reported according to the applicable regulations. These issues are often discovered through the use of specialized software programs that track changes in financial statements over time.

In addition, auditors may also look for potential violations related to other laws and regulations, such as those governing labor practices or environmental standards. For example, if an organization fails to comply with minimum wage requirements or does not properly dispose of hazardous materials, it could be liable for significant fines or penalties. Similarly, any discrepancies regarding tax compliance could result in severe consequences for government agencies responsible for enforcing these laws.

It is important for organizations undergoing a compliance audit to understand their obligations under relevant laws and regulations so they can adequately prepare for the audit process. Companies should strive to maintain accurate records and ensure that all documents are up-to-date prior to the start of the audit. Additionally, companies must be able to demonstrate how they monitor their own activities in order to remain compliant with various legal requirements on an ongoing basis. Doing this increases the chances of passing a compliance audit without incurring costly sanctions or penalties resulting from non-compliance issues identified by auditors during the course of their work.

- How Can I Ensure That My Compliance Audit Is Successful?

A successful compliance audit requires a well-executed plan and strategy. Preparation is paramount when it comes to achieving success in a compliance audit. It is important for an organization to have a comprehensive understanding of the overall process, understand potential risks, and develop ways to address them and maintain effective internal controls over financial reporting. In order to ensure that a compliance audit goes smoothly and achieves its desired outcomes, there are various steps that must be taken prior to commencing the audit.

The first step in preparing for a compliance audit is to create an audit compliance checklist. This checklist should include all applicable regulations or standards that pertain to the particular industry within which the company operates. Additionally, areas such as risk management strategies, internal control systems, processes used for data entry as well as record keeping practices should also be assessed as part of this exercise. With these items addressed ahead of time, organizations can identify any non-compliant areas before they become issues during the actual audit process.

Once the initial review has been completed using the created checklist, companies must carefully consider their individual approach toward executing the audit process itself. The development of an effective compliance audit strategy will take into account elements like document collection procedures, software tools available for use during audits, expectations from auditors regarding timelines and deliverables, etc., thereby ensuring efficiency throughout the entire procedure without compromising on accuracy or quality of results obtained at each stage. Furthermore, teams should also factor in post-audit activities such as follow-up reviews with external agencies if required by regulation or standard being reviewed by an auditor.

By following best practices around pre-audit preparation techniques outlined above coupled with developing a robust strategy tailored specifically to meet organizational needs and goals with respect to meeting necessary requirements set forth by different governing bodies related to respective industries; organizations can significantly increase their chances of having a smooth experience while navigating through the complex world of compliance audits.

Conclusion

The compliance audit process is a complex undertaking that requires careful preparation and execution. Companies must allocate sufficient resources in order to ensure the success of their audit, as it can be costly if done improperly or incompletely. The duration of a compliance audit varies depending on the type and size of the organization being audited; however, audits can typically take weeks or even months to complete.

Organizations should also be aware of potential risks associated with a compliance audit such as non-compliance issues, errors in documentation, discrepancies between internal and external records, data breaches, etc., all of which could lead to significant penalties or fines. It is important that organizations understand and adhere to applicable laws and regulations before beginning an audit as this will reduce the risk of incurring any financial losses due to non-compliance.

Ultimately, the successful completion of a compliance audit depends upon proper planning and execution throughout each step of the process. Organizations must utilize both internal and external resources including technology solutions in order to identify areas where they may lack adherence to legal requirements. By properly preparing for an audit prior to its commencement, companies can minimize potential risks and maximize their chances of achieving satisfactory results during their compliance audit.